Affiliate Disclosure

HVAC Guide Guys is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.

Can Homeowners Insurance Cover HVAC Systems? “The secret of getting ahead is getting started.” – Mark Twain

As a homeowner, your HVAC system is key to a comfortable home all year. But what if disaster hits and your HVAC needs fixing or replacing? Homeowners insurance can help a lot. But does it really cover HVAC damages?

Key Takeaways

- Homeowners insurance usually covers HVAC systems for damage from things like fire, lightning, or falling trees.

- The type of HVAC unit and your policy coverage decide how much protection you get.

- Standard policies don’t cover wear and tear, neglect, or age-related HVAC problems.

- Equipment breakdown coverage can offer extra protection for your HVAC system.

- It’s important to document damage and follow the claims process to get your HVAC repairs or replacement covered.

Table of Contents

Understanding HVAC Systems and Home Insurance Basics

As a homeowner, knowing your HVAC system is key. It’s also important to understand how your home insurance can help with HVAC damages. Let’s look at the basics and how your HVAC system and insurance work together.

What Is an HVAC System?

An HVAC system controls your home’s temperature, air, and quality. It has a furnace or heat pump for heat, an air conditioner for cooling, ducts for air distribution, and a thermostat for control.

Components of a Standard HVAC Setup

- Furnace or heat pump: Responsible for heating the air

- Air conditioner: Cools and dehumidifies the air

- Ductwork: Distributes the conditioned air throughout the home

- Thermostat: Allows you to control the temperature and settings

Basic Home Insurance Coverage Types

Homeowners insurance usually has three main types that matter for your HVAC:

- Dwelling Coverage: Protects your home’s structure, including HVAC parts.

- Personal Property Coverage: Covers your stuff, like window units.

- Liability Coverage: Helps if someone gets hurt on your property because of HVAC issues.

Knowing these basics helps you deal with HVAC claims and keeps your home safe.

Explore Our HVAC Shop

Looking for top-rated HVAC tools, parts, and accessories? Visit our shop and find the perfect solution for your needs.

Visit the ShopWhen Does Home Insurance Cover HVAC Damage?

Your homeowners insurance might cover HVAC damage, but it depends on the situation. Usually, home insurance protects against covered perils like fire, lightning, windstorms, hail, or theft. These can harm your HVAC equipment.

For instance, if lightning hits your home and damages your HVAC’s electrical parts, your policy might help with repairs or replacement. The coverage is based on your policy limits and deductibles.

But, home insurance doesn’t cover damage from normal wear and tear or neglect. If your HVAC system breaks down because it’s old or not maintained, you’ll have to pay for the fixes or a new one.

“Home insurance may cover HVAC damage caused by covered perils, but not damage due to normal wear and tear or neglect.”

It’s crucial to check your homeowners insurance policy to know what’s covered for HVAC. Talking to your insurance provider can help you find the right coverage for your HVAC needs. This way, you’ll be ready for any HVAC insurance claims.

Explore Our HVAC Shop

Looking for top-rated HVAC tools, parts, and accessories? Visit our shop and find the perfect solution for your needs.

Visit the ShopCan Homeowners Insurance Cover HVAC: Coverage Types and Limits

Your homeowners insurance can help protect your home’s HVAC system. The coverage depends on your HVAC setup and the damage type. It’s important to know what your policy covers.

Dwelling Coverage for Central Units

Central HVAC units are usually covered under your policy’s dwelling coverage. This includes damage from fires or lightning. Your policy might cover the cost to fix or replace it.

Personal Property Coverage for Window Units

Window or portable HVAC units are covered under personal property. This means your policy can help if they’re stolen or damaged. It’s a good idea to check your policy for this coverage.

Additional Coverage Options

Some policies offer extra coverage for HVAC systems. You might get coverage for equipment breakdowns. This helps if your unit fails mechanically or electrically. Home warranty programs also offer broad coverage for HVAC and other appliances.

It’s crucial to understand your policy’s details. Know the coverage limits and deductibles for your HVAC. This ensures your home and HVAC equipment are well-protected.

| Coverage Type | HVAC System Coverage | Typical Limits and Deductibles |

|---|---|---|

| Dwelling Coverage (Coverage A) | Central HVAC units as part of the home’s structure | Covered up to the policy limits, with a deductible that may range from $500 to $2,000 or more |

| Personal Property Coverage (Coverage C) | Window or portable HVAC units | Covered up to the personal property limits, with a deductible that may range from $500 to $2,000 or more |

| Equipment Breakdown Coverage (Optional) | Mechanical or electrical failures of HVAC systems | Covered up to the policy limits, with a deductible that may range from $500 to $2,000 or more |

| Home Warranty Programs (Optional) | Comprehensive coverage for HVAC systems and other home appliances | Varies by provider, but typically include a service fee for each repair or replacement |

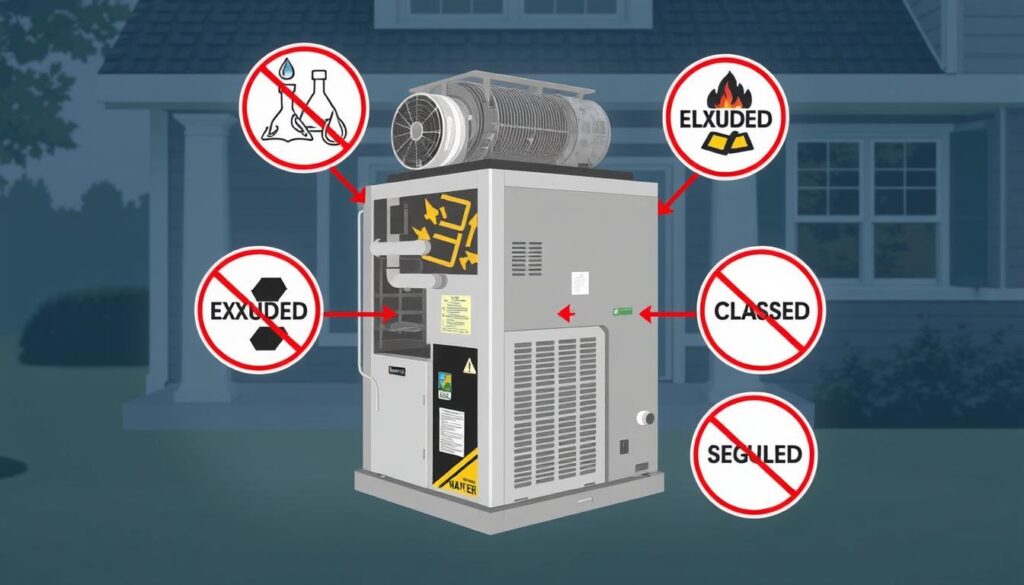

Common Exclusions in HVAC Coverage

Understanding policy exclusions is key for HVAC coverage in homeowners insurance. Your policy might protect against some HVAC damage, but there are exclusions you should know.

Normal wear and tear is a big exclusion. Homeowners insurance doesn’t cover gradual damage or failure of your HVAC system. If your furnace or air conditioner breaks down from age or lack of maintenance, you might have to pay for repairs or a new one yourself.

Another exclusion is manufacturer defects. If your HVAC system fails because of a design or manufacturing flaw, your policy might not cover the costs. You might need to rely on the manufacturer’s warranty or extended service plans for repairs or replacements.

- Damage from earthquakes or floods is usually not covered by standard homeowners policies, requiring separate earthquake or flood insurance.

- Cosmetic damage, such as hail dents on your outdoor air conditioning unit, may also be excluded in some states.

It’s important to carefully review your homeowners insurance policy. This way, you’ll know the specific exclusions for your HVAC system. It helps you make smart decisions about keeping your equipment in good shape and when to file a claim.

“The average homeowners insurance deductible is around $1,000, which is significant to consider when assessing whether to file a claim for HVAC system repair or replacement.”

Knowing about these common exclusions helps you plan for your HVAC system’s maintenance and potential replacement. This ensures you’re well-protected against unexpected damages.

Explore Our HVAC Shop

Looking for top-rated HVAC tools, parts, and accessories? Visit our shop and find the perfect solution for your needs.

Visit the ShopFiling an HVAC Insurance Claim

Dealing with HVAC system damage can be complex. But, by following the right steps and providing the necessary documentation, you can navigate the HVAC claim process effectively. This increases your chances of a successful outcome.

Required Documentation

To file an HVAC insurance claim, you’ll need to gather crucial information about your unit. This includes the model and serial number, as well as photographic evidence of the visible damage. If the HVAC damage is due to a covered peril like theft or vandalism, be sure to obtain a police report as well.

Steps in the Claims Process

- Notify your insurance provider promptly about the HVAC system damage.

- Provide all the necessary information, such as the details of the incident and the extent of the damage.

- Cooperate with the insurance adjuster during their assessment of the HVAC unit.

- Keep detailed records of all communications, repair estimates, and invoices throughout the claims process.

Working with Insurance Adjusters

The insurance adjuster will play a crucial role in determining the coverage and compensation for your HVAC claim. Be prepared to discuss the age and condition of the unit, as well as any recent maintenance history. Provide the adjuster with all the relevant documentation to support your claim.

By following these steps and maintaining thorough records, you can navigate the HVAC claim process with confidence. This increases your chances of a favorable outcome from your insurance provider.

Alternative Coverage Options for HVAC Systems

Homeowners insurance might not cover your HVAC system fully. But, there are other ways to protect your heating, ventilation, and air conditioning. These options can help if your system breaks down or needs an unexpected repair.

Home Warranty Programs

Home warranty programs can cover HVAC repairs, no matter the cause. They often include coverage for your furnace, air conditioner, and other parts. This gives you extra protection beyond what insurance offers. Costs range from $44 to $109 monthly, with service fees from $65 to $125.

Equipment Breakdown Coverage

Equipment breakdown coverage is another choice. It pays for fixing or replacing your HVAC if it fails due to mechanical or electrical issues. You can add it to your homeowners policy or get it as a standalone policy.

HVAC Protection Plans

Insurance companies or HVAC providers offer HVAC protection plans. These include regular maintenance, repair discounts, and replacement coverage. They help keep your system in top shape.

When looking at these options, check the costs, coverage limits, and what’s not included. Research and compare to find the best coverage for your needs. This way, you can have peace of mind and protect your home’s systems.

| Coverage Option | Average Monthly Cost | Service Fees | Annual Cost | Coverage Limits |

|---|---|---|---|---|

| Home Warranty | $44 – $109 | $65 – $125 | $528 – $700 | Around $2,000 |

| Equipment Breakdown Coverage | Varies | Varies | Varies | Varies |

| HVAC Protection Plan | Varies | Varies | Varies | Varies |

“Home warranty providers offer a crucial safety net for HVAC systems, but it’s important to understand the coverage limits and exclusions to ensure you’re getting the protection you need.”

Explore Our HVAC Shop

Looking for top-rated HVAC tools, parts, and accessories? Visit our shop and find the perfect solution for your needs.

Visit the ShopPreventive Maintenance and Insurance Considerations

Keeping your HVAC system in good shape is key. It helps your system last longer and makes sure your insurance claims get approved. Regular care is important for successful claims.

Regular Maintenance Requirements

Experts say your HVAC system needs an annual check-up. This includes cleaning filters, checking electrical parts, and making sure air flows right. Without this, you might face costly repairs that insurance won’t cover.

Impact on Insurance Claims

Keeping records of your HVAC’s maintenance is crucial. It shows you’ve been taking care of it, which helps with claims. Without these records, your claim might get denied, as insurers might think you were careless.

| Maintenance Task | Frequency | Impact on Insurance Claims |

|---|---|---|

| Air filter replacement | Every 1-3 months | Proper filter maintenance can prevent damage and support claims |

| Ductwork cleaning | Every 1-2 years | Clean ducts help maintain system efficiency and prevent issues |

| Refrigerant level check | Annual servicing | Proper refrigerant levels are crucial for optimal HVAC performance |

| Thermostat calibration | Annual servicing | Ensures accurate temperature control and helps avoid issues |

Focus on regular HVAC maintenance and keep good records. This protects your system and helps with insurance claims for HVAC-related damage.

Cost Factors and Insurance Premiums

Several factors affect HVAC coverage costs. Your deductible and coverage limits are key. Higher deductibles mean lower payments but more costs if you claim. More coverage limits mean better protection but cost more.

A Consumer Reports survey found over 20% of new appliances fail in the first four years. This highlights the need to understand your HVAC coverage and repair or replacement costs. Finding the right balance between protection and cost is crucial.

| Cost Factor | Impact on Premiums | Impact on Out-of-Pocket Expenses |

|---|---|---|

| Deductible | Higher deductibles lower premiums | Higher deductibles increase out-of-pocket costs for repairs |

| Coverage Limits | Higher coverage limits increase premiums | Higher coverage limits provide more protection for HVAC system replacement |

To get the best value for your HVAC coverage, compare quotes from different providers. This way, you can find a policy that fits your needs and budget.

“Regular maintenance of furnaces and boilers can extend their life span and prevent breakdowns.”

Keeping your HVAC system in good shape can also affect your insurance. Regular maintenance can make your system more efficient. This might lower your energy bills and reduce the chance of expensive breakdowns.

Explore Our HVAC Shop

Looking for top-rated HVAC tools, parts, and accessories? Visit our shop and find the perfect solution for your needs.

Visit the ShopTips for Maximizing Your HVAC Coverage

Understanding HVAC insurance optimization can be tough. But, with the right policy review tips and strategies, you can make sure your coverage maximization for your home’s heating, ventilation, and air conditioning system. Here are some key things to remember:

Documentation Best Practices

It’s important to keep detailed records of your HVAC system’s maintenance, repairs, and upgrades. Store invoices, service receipts, and any work done on your unit. This info can help a lot when you need to make an insurance claim.

Policy Review Guidelines

- Check your homeowner’s insurance policy often to make sure your HVAC system is covered as it gets older or is replaced.

- Think about adding equipment breakdown coverage to your policy. It can give full protection for your HVAC system if it fails mechanically or electrically.

- Work with an independent insurance agent. They can help you customize your policy to fit your needs and situation. This way, you’ll have the right coverage for your HVAC system.

By following these HVAC insurance optimization tips and policy review guidelines, you can get the most out of your coverage. This will protect your home’s climate control system from unexpected damages or breakdowns.

Conclusion

Understanding your HVAC coverage in your homeowner’s insurance is key. Most policies cover damage from fires, lightning, or theft. But, they don’t cover normal wear and tear. This shows why keeping your HVAC in good shape is so important.

Regular maintenance, clean filters, and professional checks can help your system last longer. This might save you from expensive repairs.

It’s also smart to check your policy’s limits and deductibles. This way, you know how much you’re covered for and what you might have to pay out of pocket. Looking into extra coverage, like equipment breakdown insurance, can add more protection for your HVAC.

By being proactive with your HVAC insurance, you can protect your home and budget. This is especially true when unexpected problems come up.

Your HVAC system is vital to your home. Making sure it’s covered by insurance is a big part of being a responsible homeowner. By focusing on maintenance, reviewing your policy, and considering extra coverage, you can feel secure. You’ll know your home and investment are safe.