Affiliate Disclosure

HVAC Guide Guys is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.

Does Commercial HVAC Qualify for Bonus Depreciation? This tax incentive aims to encourage businesses to invest in energy-efficient HVAC systems, reducing their carbon footprint and saving on energy costs over time. By taking advantage of bonus depreciation, businesses can not only improve their indoor comfort and air quality but also benefit from substantial tax savings.

Yes, commercial HVAC systems qualify for bonus depreciation. Commercial HVAC systems are considered eligible for bonus depreciation under the current tax laws, allowing businesses to deduct a significant portion of the cost in the first year of purchase.

Table of Contents

Credit: www.ajmfg.com

Introduction To Bonus Depreciation

When it comes to managing finances and taxes for your commercial HVAC business, understanding the concept of bonus depreciation is crucial. Bonus depreciation is a tax incentive that allows businesses to deduct a significant portion of the cost of qualifying property in the year it is placed in service. This can result in substantial tax savings and improved cash flow for your business.

Basics Of Bonus Depreciation

Before we delve into the recent changes and updates regarding bonus depreciation, let’s first understand the basics. Bonus depreciation allows businesses to deduct a percentage of the cost of qualifying property upfront, rather than spreading it out over several years. This accelerated depreciation helps stimulate business investment and economic growth. The Tax Cuts and Jobs Act (TCJA) of 2017 significantly expanded bonus depreciation, making it more beneficial for businesses.

Here are some key points to remember:

- Bonus depreciation applies to new, used, or off-the-shelf property that has a useful life of 20 years or less.

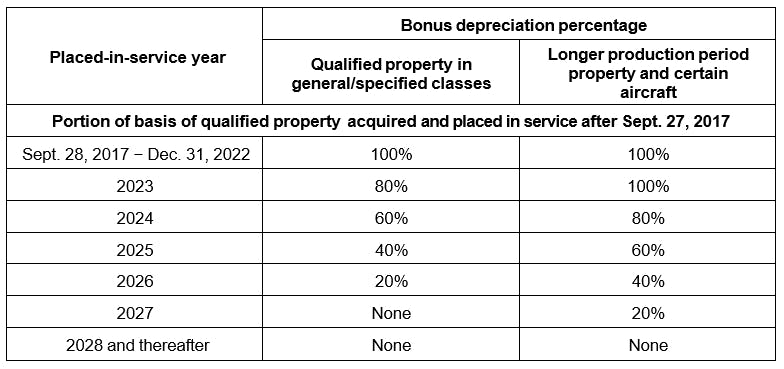

- The percentage of bonus depreciation was increased to 100% under the TCJA for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023.

- Qualified property includes machinery, equipment, furniture, and certain improvements to non-residential buildings, such as HVAC systems.

- The bonus depreciation deduction is taken in addition to any regular depreciation deduction.

Recent Changes And Updates

It is essential to stay informed about recent changes and updates to bonus depreciation to maximize its benefits for your commercial HVAC business. Here are some noteworthy updates:

1. Phase-out Period: Starting from January 1, 2023, the bonus depreciation percentage will begin to phase out gradually. It will decrease by 20% each year until it reaches 0% in 2027.

2. Used Property Eligibility: Under the TCJA, used property that was not previously eligible for bonus depreciation can now qualify. This change provides businesses with more opportunities to take advantage of bonus depreciation when acquiring pre-owned HVAC equipment.

3. Qualified Improvement Property: The CARES Act of 2020 made a technical correction to include qualified improvement property (QIP) as eligible for bonus depreciation. QIP refers to certain interior improvements made to non-residential buildings, including HVAC upgrades. This correction allows businesses to retroactively claim bonus depreciation for eligible QIP placed in service after September 27, 2017.

4. Electing Out: While bonus depreciation can be highly beneficial, businesses have the option to elect out of it on a property-by-property basis. This choice might be suitable for businesses with specific tax planning strategies or those wanting to spread out their deductions over time.

By staying up to date with these recent changes and updates, you can make informed decisions regarding bonus depreciation and leverage it to your advantage. Properly applying bonus depreciation to your commercial HVAC equipment purchases can lead to significant tax savings and increased profitability for your business.

Explore Our HVAC Shop

Looking for top-rated HVAC tools, parts, and accessories? Visit our shop and find the perfect solution for your needs.

Visit the ShopCommercial HVAC Essentials

Commercial HVAC essentials are a crucial consideration for business owners and property managers, especially when it comes to the potential for bonus depreciation. Understanding what constitutes commercial HVAC and the importance of HVAC systems in commercial spaces is essential for making informed decisions about tax benefits and long-term investments.

What Constitutes Commercial Hvac?

Commercial HVAC refers to heating, ventilation, and air conditioning systems that are installed in non-residential buildings, such as office buildings, retail stores, restaurants, and industrial facilities. These systems are designed to provide a comfortable and healthy indoor environment for occupants while also maintaining optimal conditions for equipment and processes.

Importance Of HVAC In Commercial Spaces

Commercial HVAC systems play a critical role in maintaining indoor air quality, regulating temperature and humidity levels, and ensuring the comfort of employees, customers, and visitors. Additionally, these systems are essential for preserving product integrity, supporting manufacturing processes, and safeguarding sensitive equipment in various commercial settings.

Eligibility For Bonus Depreciation

When it comes to commercial HVAC systems, there is a question that often arises among business owners and facility managers: does commercial HVAC qualify for bonus depreciation? Understanding the eligibility for bonus depreciation is crucial for businesses looking to make the most of tax benefits.

General Criteria

For a commercial HVAC system to qualify for bonus depreciation, it must meet the general criteria set forth by the Internal Revenue Service (IRS). The system must be purchased and placed in service after September 27, 2017, and before January 1, 2023. Additionally, the equipment must have a depreciable life of 20 years or less, in accordance with the Modified Accelerated Cost Recovery System (MACRS).

Specifics For Commercial HVAC Systems

Specifically for commercial HVAC systems, the equipment must meet certain efficiency and performance standards to qualify for bonus depreciation. The system must be in compliance with the energy efficiency requirements outlined in the Energy Policy Act of 2005. This includes meeting the minimum Seasonal Energy Efficiency Ratio (SEER) and Energy Efficiency Ratio (EER) ratings as defined by the Department of Energy.

Explore Our HVAC Shop

Looking for top-rated HVAC tools, parts, and accessories? Visit our shop and find the perfect solution for your needs.

Visit the ShopImpact Of The Tax Cuts And Jobs Act

The Tax Cuts and Jobs Act (TCJA) has brought significant changes to the commercial HVAC industry, particularly in terms of bonus depreciation. The TCJA allows for 100% bonus depreciation on qualifying property purchased and placed in service after September 27, 2017, and before January 1, 2023. This means that HVAC systems may now qualify for bonus depreciation, resulting in significant tax savings for commercial building owners.

Before And After Case Studies

Before the TCJA, commercial building owners were only able to claim 50% bonus depreciation on HVAC systems. However, with the new legislation, HVAC systems now qualify for 100% bonus depreciation, resulting in significantly higher tax savings. For example, a commercial building owner who purchased and installed a new HVAC system for $100,000 before the TCJA would only have been able to claim $50,000 in bonus depreciation. However, with the new legislation, the same building owner can now claim the full $100,000 in bonus depreciation, resulting in a substantial tax savings.

Qualifying For Bonus Depreciation

In order to qualify for bonus depreciation, the HVAC system must meet certain requirements. The system must be new and not previously used by anyone else, and it must be installed in a non-residential building. Additionally, the system must have a depreciable life of 20 years or less, which most HVAC systems do. It’s important to consult with a tax professional to ensure that your HVAC system meets all the necessary requirements to qualify for bonus depreciation.

The Tax Cuts and Jobs Act has had a significant impact on the commercial HVAC industry, allowing for substantial tax savings for building owners who install new HVAC systems. By taking advantage of 100% bonus depreciation, commercial building owners can save thousands of dollars on their taxes. It’s important to consult with a tax professional to ensure that your HVAC system meets all the necessary requirements to qualify for bonus depreciation and maximize your tax savings.

Calculating Bonus Depreciation For HVAC

Commercial HVAC equipment typically qualifies for bonus depreciation, which allows businesses to write off a significant portion of the equipment’s cost in the year it is placed in service. The bonus depreciation rate for HVAC systems is currently 100%, but it is important to consult with a tax professional to ensure eligibility and proper calculation of the deduction.

Step-by-step Guide

Calculating bonus depreciation for HVAC involves specific steps:

- Determine the cost of the HVAC system.

- Identify the applicable bonus depreciation percentage.

- Multiply the cost by the bonus depreciation percentage.

- Apply the resulting bonus depreciation amount to taxes.

Examples

Here are some examples to illustrate the calculation process:

- Cost of HVAC system: $50,000

- Bonus depreciation percentage: 50%

- Bonus depreciation amount: $25,000

- Tax savings: $25,000 x Tax Rate

Benefits For Business Owners

Commercial HVAC systems are essential for the smooth functioning of businesses. They help maintain a comfortable environment for employees and customers, which ultimately leads to increased productivity and better sales. However, purchasing and installing HVAC systems can be costly for business owners. Fortunately, the government offers tax incentives to encourage businesses to invest in energy-efficient HVAC systems. One such incentive is bonus depreciation, which allows businesses to write off a significant portion of the cost of their HVAC systems in the year of purchase.

Tax Savings

Bonus depreciation is a tax incentive that allows businesses to depreciate qualifying property faster than standard depreciation. Under the Tax Cuts and Jobs Act (TCJA), businesses can now deduct up to 100% of the cost of qualified property in the year it is placed in service. This means that if a business purchases and installs a commercial HVAC system, they may be able to write off the entire cost of the system in the year of purchase, resulting in significant tax savings.

Improved Cash Flow

By taking advantage of bonus depreciation, businesses can improve their cash flow by reducing their tax liability in the year of purchase. This means that businesses can keep more of their money in the short term, which can be used to reinvest in the company, pay down debt, or simply increase their bottom line. Additionally, the energy savings that come with an energy-efficient HVAC system can also help improve cash flow by reducing energy bills.

Overall, bonus depreciation can be a significant financial benefit for businesses looking to invest in energy-efficient HVAC systems. By reducing tax liability and improving cash flow, businesses can see a quick return on their investment and enjoy the many benefits of a comfortable and energy-efficient work environment.

Explore Our HVAC Shop

Looking for top-rated HVAC tools, parts, and accessories? Visit our shop and find the perfect solution for your needs.

Visit the ShopCommon Misconceptions

Common misconceptions about commercial HVAC and bonus depreciation often lead to confusion among business owners.

Myths Debunked

1. HVAC systems do qualify for bonus depreciation if they meet certain criteria.

2. HVAC upgrades are not automatically disqualified from bonus depreciation.

3. Bonus depreciation can apply to both new installations and replacement HVAC units.

Facts Vs. Fiction

1. Commercial HVAC systems can qualify for bonus depreciation under the right circumstances.

2. Upgrading HVAC systems does not always disqualify businesses from bonus depreciation benefits.

Credit: www.commercialcreditgroup.com

Navigating Complexities

Discovering if commercial HVAC systems qualify for bonus depreciation involves navigating through intricate guidelines and regulations. Understanding the nuances of this tax incentive can significantly benefit businesses looking to optimize their financial strategies.

Consulting A Professional

Staying Updated

Navigating the complexities of whether Commercial HVAC qualifies for Bonus Depreciation can be daunting. Consulting a professional ensures accurate guidance. It’s crucial for businesses to stay updated on tax laws to maximize benefits. Reaching out to experts helps in making informed decisions.

Consulting A Professional

Considering tax implications, consulting a professional is essential.

– Experts provide accurate guidance.

– Maximize benefits with their help.

– Informed decisions are crucial for businesses.

Staying Updated

Staying updated on tax laws is vital for maximizing benefits.

– Continuous learning is key.

– Maximize deductions through awareness.

– Seize opportunities with up-to-date information.

Credit: www.bakertilly.com

Explore Our HVAC Shop

Looking for top-rated HVAC tools, parts, and accessories? Visit our shop and find the perfect solution for your needs.

Visit the ShopFrequently Asked Questions

Is Commercial HVAC Equipment Eligible For Bonus Depreciation?

Yes, commercial HVAC equipment typically qualifies for bonus depreciation. The Tax Cuts and Jobs Act of 2017 allows businesses to deduct a significant percentage of the cost of new HVAC systems in the year they are placed in service, providing substantial tax benefits.

What Types Of HVAC Systems Are Eligible For Bonus Depreciation?

Most types of commercial HVAC systems, including heating, ventilation, air conditioning, and refrigeration equipment, are eligible for bonus depreciation. This includes new, used, and remanufactured equipment, as long as it meets the specified requirements outlined in the tax regulations.

Are There Specific Requirements For Claiming Bonus Depreciation On HVAC Systems?

Yes, to qualify for bonus depreciation, the HVAC equipment must meet certain energy efficiency standards. It should also be placed in service after September 27, 2017, and before January 1, 2023. Businesses should consult with tax professionals to ensure compliance with all eligibility criteria.

How Does Bonus Depreciation Benefit Businesses Investing In HVAC Systems?

Bonus depreciation allows businesses to deduct a significant portion of the HVAC system’s cost in the first year, reducing tax liability and improving cash flow. This incentive encourages investment in energy-efficient HVAC equipment, providing financial advantages for eligible businesses.

Conclusion for Does Commercial HVAC Qualify for Bonus Depreciation

Understanding the eligibility of commercial HVAC for bonus depreciation is crucial for businesses. Taking advantage of this tax incentive can lead to significant cost savings and improved cash flow. Consult with a tax professional to ensure compliance and maximize benefits for your HVAC investments.