Affiliate Disclosure

HVAC Guide Guys is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.

Can HVAC Be Section 179 Deductible? Section 179 of the Internal Revenue Code allows businesses to deduct the full cost of qualifying equipment, including HVAC systems, in the year they are purchased and put into service, rather than depreciating the cost over several years. This tax incentive is beneficial for small and medium-sized businesses looking to invest in HVAC upgrades or installations, as it helps to reduce their taxable income and provides a financial incentive for improving energy efficiency and comfort in their facilities.

Yes, HVAC can be eligible for Section 179. Now let’s dive into the details.

It’s important to consult with a tax professional to ensure eligibility and take advantage of the Section 179 deduction for HVAC expenses.

Table of Contents

Credit: gopaschal.com

Introduction To HVAC And Section 179

HVAC systems can be considered Section 179 property if they meet certain requirements. This means that business owners can deduct the full cost of the HVAC system from their taxes in the year of purchase, rather than spreading the deduction out over several years.

Basics Of HVAC Systems

HVAC, which stands for Heating, Ventilation, and Air Conditioning, refers to the technology used for indoor environmental comfort. HVAC systems are designed to regulate temperature, humidity, and air quality in residential, commercial, and industrial buildings. These systems work by controlling the heating and cooling of spaces, as well as the circulation and filtration of air.

Proper HVAC installation and maintenance are essential for ensuring a comfortable and healthy living or working environment. HVAC systems can vary in complexity and size depending on the specific needs of the building. They typically consist of various components, including furnaces, heat pumps, air conditioners, ventilation systems, and ductwork.

What Is Section 179?

Section 179 is a tax deduction provision that allows businesses to deduct the full purchase price of qualifying equipment or software during the tax year. This deduction was created to encourage businesses to invest in new equipment and stimulate economic growth. HVAC systems are among the eligible equipment that can be claimed under Section 179.

Before Section 179, businesses were required to depreciate the cost of equipment over several years. However, Section 179 allows businesses to deduct the full cost of qualifying equipment in the year it is purchased and placed into service. This deduction has significant financial advantages as it reduces the overall taxable income, resulting in lower tax liability.

It’s important to note that not all HVAC expenses qualify for Section 179 deduction. The equipment must meet certain criteria, such as being used for business purposes, being purchased or financed, and being within the specified spending limits set by the IRS.

By taking advantage of Section 179, businesses can not only improve their indoor comfort with upgraded HVAC systems but also enjoy potential tax savings. It’s crucial for businesses to consult with their tax professionals or accountants to determine if they qualify for the Section 179 deduction and understand the specific requirements and limitations.

Explore Our HVAC Shop

Looking for top-rated HVAC tools, parts, and accessories? Visit our shop and find the perfect solution for your needs.

Visit the ShopEligibility Criteria For HVAC Systems

The eligibility criteria for HVAC systems under Section 179 of the tax code determine which types of HVAC systems are covered and what qualification standards must be met. Understanding these criteria is essential for businesses seeking to take advantage of the tax benefits offered by Section 179 for HVAC investments.

Types Of HVAC Systems Covered

Under Section 179, various types of HVAC systems are eligible for tax benefits, including heating, ventilation, air conditioning, and refrigeration systems. These systems must be used for commercial purposes to qualify for the tax deductions.

Understanding Qualification Standards

Qualification standards for HVAC systems under Section 179 involve meeting specific requirements related to the system’s energy efficiency and installation dates. The system must meet the standards set by the Department of Energy and have been installed within the tax year for which the deduction is being claimed.

The Financial Impact Of Section 179 On Businesses

Tax Savings Explained

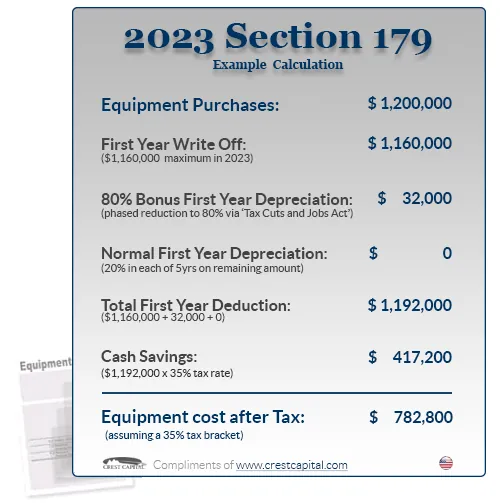

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. This deduction encourages businesses to invest in themselves by purchasing or leasing equipment and off-the-shelf software. By deducting the full purchase price, businesses can save on their tax bill, reducing the overall cost of acquiring the equipment.

Case Studies: Real-world Examples

Real-world examples illustrate the significant financial impact of Section 179 on businesses of all sizes. For instance, a small business that invests in HVAC equipment can take advantage of Section 179 to significantly reduce their tax burden, freeing up capital for other operational needs. Similarly, a medium-sized business can leverage this tax provision to make strategic investments in HVAC systems, benefiting from substantial tax savings that positively impact their bottom line.

Credit: gopaschal.com

Explore Our HVAC Shop

Looking for top-rated HVAC tools, parts, and accessories? Visit our shop and find the perfect solution for your needs.

Visit the ShopHow To Claim Your HVAC System Under Section 179

As a business owner, you might have invested in an HVAC system for your office or commercial space. The good news is that you can claim this expense under Section 179 of the Internal Revenue Code. This means you can deduct the cost of your HVAC system from your taxable income, thus reducing your tax liability. However, claiming your HVAC system under Section 179 can be a tricky process if you’re not familiar with the rules and regulations. In this article, we’ll provide you with a step-by-step guide on how to claim your HVAC system under Section 179, as well as common pitfalls to avoid.

Step-by-Step Guide

Here’s a step-by-step guide on how to claim your HVAC system under Section 179:

- Determine if your HVAC system qualifies for Section 179. Not all HVAC systems are eligible for this deduction, so make sure you check with your tax advisor or accountant.

- Calculate the cost of your HVAC system. This includes the cost of the equipment, installation, and any necessary modifications to your building.

- Fill out IRS Form 4562. This form is used to claim depreciation and amortization deductions, including those for Section 179 expenses.

- Enter the cost of your HVAC system on line 6 of Form 4562.

- Transfer the amount from line 6 to line 13 of Form 4562.

- Enter the total amount of Section 179 expenses on line 14 of Form 4562.

- Attach Form 4562 to your tax return.

It’s important to note that the maximum amount you can deduct under Section 179 is $1,050,000 for the tax year 2021. Additionally, the total amount of equipment and property you can purchase and deduct under Section 179 is $2,620,000.

Common Pitfalls To Avoid

While claiming your HVAC system under Section 179 can provide significant tax savings, there are some common pitfalls to avoid:

- Make sure your HVAC system qualifies for Section 179. Not all HVAC systems are eligible for this deduction, so it’s important to check with your tax advisor or accountant.

- Keep accurate records. You’ll need to keep detailed records of the cost of your HVAC system and any related expenses, as well as proof of payment.

- Don’t exceed the maximum deduction limit. As mentioned earlier, the maximum amount you can deduct under Section 179 is $1,050,000 for the tax year 2021.

- Don’t forget to attach Form 4562 to your tax return. Failing to attach this form can result in your deduction being disallowed.

By following these steps and avoiding common pitfalls, you can successfully claim your HVAC system under Section 179 and reduce your tax liability.

Limitations And Restrictions

Discover the limits and restrictions regarding HVAC Section 179 eligibility for tax deductions. Understanding the rules and qualifications is crucial for maximizing tax benefits.

Caps And Thresholds

There are caps and thresholds to consider when utilizing Section 179 for HVAC expenses.

What Does Not Qualify

It’s crucial to understand what expenses do not qualify for Section 179 benefits.

Credit: www.ac-heatingconnect.com

Planning For The Future: HVAC Investments

As a business owner or manager, you understand the importance of investing in your company’s future growth. One key area to consider is your HVAC system. While it may not seem like the most exciting investment, upgrading or replacing your HVAC system can have a significant impact on your bottom line, both in the short and long term.

Strategic Purchasing Decisions

When it comes to making a strategic purchasing decision about your HVAC system, it’s important to consider factors beyond just the upfront cost. While it may be tempting to opt for the cheapest option, it’s important to consider the long-term savings and benefits that come with a higher quality system.

Investing in a high-quality HVAC system can help improve energy efficiency, reduce maintenance costs, and improve overall indoor air quality. Additionally, newer systems often come with advanced features such as smart thermostats, which can help further reduce energy costs and improve comfort levels.

Evaluating Long-Term Savings

When evaluating the long-term savings of a new HVAC system, it’s important to consider factors such as energy savings, maintenance costs, and potential tax incentives. One potential tax incentive to consider is Section 179 of the IRS tax code, which allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year.

By taking advantage of Section 179, businesses can significantly reduce the cost of upgrading or replacing their HVAC system, making it a more attractive investment option. Additionally, by investing in a higher quality, more energy-efficient system, businesses can continue to save on energy and maintenance costs for years to come.

Explore Our HVAC Shop

Looking for top-rated HVAC tools, parts, and accessories? Visit our shop and find the perfect solution for your needs.

Visit the ShopFaqs On HVAC And Section 179 Deductions

Yes, HVAC can be Section 179 deducted as long as it meets the requirements set by the IRS. The equipment must be new, used for business purposes, and installed in the same year the deduction is claimed. Consult with a tax professional to ensure eligibility and proper documentation.

Expert Answers To Common Questions

Can HVAC be included in Section 179 deductions?

Yes, HVAC systems can be eligible for Section 179 deductions if they meet certain criteria.

- The HVAC system must be installed in the same year it was purchased.

- The system must be used for business purposes more than 50% of the time.

- The deduction limit for HVAC systems under Section 179 is $1,080,000 for 2021.

Navigating Complex Cases

What if my HVAC system serves both residential and business areas?

If your HVAC system serves both residential and business areas, you can still claim a deduction based on the percentage of business use.

- You will need to calculate the square footage or hours of business use versus personal use.

- Consult with a tax professional to determine the appropriate deduction amount.

Conclusion: Maximizing Savings With Section 179

HVAC systems can be a significant investment for businesses. By utilizing Section 179, companies can maximize savings on HVAC purchases. This tax code allows businesses to deduct the full purchase price of qualifying equipment in the year it is placed in service, providing a substantial tax benefit.

Key Takeaways

- Section 179 enables businesses to deduct the full cost of HVAC systems in the year of purchase.

- Utilizing Section 179 can result in substantial tax savings for businesses investing in HVAC equipment.

- Businesses should consult with tax professionals to ensure eligibility and maximize benefits under Section 179.

Next Steps For Businesses

- Assess the HVAC equipment needs of your business.

- Research eligible HVAC systems that qualify for Section 179 deductions.

- Consult with a tax advisor to understand how to leverage Section 179 for maximum savings.

- Keep detailed records of HVAC purchases and installation dates for tax purposes.

Explore Our HVAC Shop

Looking for top-rated HVAC tools, parts, and accessories? Visit our shop and find the perfect solution for your needs.

Visit the ShopFrequently Asked Questions

Can HVAC Equipment Be Eligible For Section 179 Tax Deduction?

Yes, HVAC equipment can be eligible for Section 179 tax deduction if it meets the specified criteria. The Tax Cuts and Jobs Act of 2017 expanded the Section 179 deduction to include certain improvements to non-residential property, including HVAC systems.

What Type Of HVAC Equipment Qualifies For Section 179 Deduction?

Generally, HVAC equipment that is purchased and placed in service during the tax year is eligible for the Section 179 deduction. This includes heating, ventilation, and air conditioning systems, along with other qualifying improvements to non-residential properties.

Are There Limitations On The HVAC Expenses That Can Be Deducted Under Section 179?

Yes, there are limitations on the total amount of HVAC expenses that can be deducted under Section 179. Taxpayers should consult with a tax professional to determine the specific limitations and eligibility criteria for claiming the deduction for HVAC equipment.

Conclusion for Can HVAC Be Section 179 Deductible

Incorporating HVAC under Section 179 can yield significant tax benefits for businesses. By capitalizing on this tax provision, companies can enhance their bottom line while improving indoor comfort. Understanding the nuances of Section 179 can help businesses make informed decisions regarding HVAC investments.

Stay informed and maximize your tax savings.