Affiliate Disclosure

HVAC Guide Guys is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.

How Long Do You Depreciate HVAC on Residential Rental Property? Ever thought about how rental property owners save on taxes with HVAC depreciation? Property investment has a complex strategy that can save you thousands. It’s all about making smart financial moves.

Knowing how to depreciate HVAC on rental properties is key for savvy investors. The IRS offers guidelines to help manage your property’s finances wisely.

For hvac depreciation in residential rentals, central air systems depreciate over 27.5 years. This allows you to spread out tax deductions for nearly three decades. It’s a great way to get tax benefits over time.

But, different HVAC systems have different depreciation periods. For example, window units and portable air conditioners depreciate in just 7 years. This affects your tax benefits.

Key Takeaways

- Central HVAC systems depreciate over 27.5 years for residential rentals

- Window units have a shorter 7-year depreciation period

- Proper documentation is critical for tax reporting

- HVAC improvements can provide significant tax advantages

- Understanding IRS guidelines helps maximize tax benefits

Table of Contents

Understanding HVAC Depreciation for Rental Properties

Investing in rental properties means knowing how to use financial strategies to boost your earnings. HVAC depreciation is key to tax planning for property owners. It offers big financial benefits if done right.

Defining HVAC Depreciation

HVAC depreciation helps recover the cost of heating, ventilation, and air conditioning systems in rental properties. The IRS lets property owners claim tax deductions for the systems’ decreasing value over time.

Critical Importance of Precise Calculations

Getting the HVAC depreciation right can lead to big tax savings. By using these deductions, property owners can lower their taxable income. HVAC systems in rental properties last about 27.5 years, giving owners a chance for tax benefits every year.

- Capital improvements are depreciated over 27.5 years

- Repair expenses can be deducted in the same year

- Annual deduction limits apply based on property value

Tax Benefits for Property Owners

Rental property tax deductions for HVAC systems can really help financially. By knowing and using the right depreciation strategies, you can:

- Lower your annual tax bill

- Offset your rental income

- Spread out the cost of replacing systems

Pro tip: Keep detailed records to back up your depreciation claims and get the most tax savings.

Explore Our HVAC Shop

Looking for top-rated HVAC tools, parts, and accessories? Visit our shop and find the perfect solution for your needs.

Visit the ShopHow Long Do You Depreciate HVAC on Residential Rental Property

Understanding IRS guidelines is key to getting the most tax benefits from depreciating HVAC systems in rental properties. The rules for depreciating HVAC systems can affect your tax strategy.

The IRS has a clear rule for depreciating HVAC systems in rental homes. They follow the Modified Accelerated Cost Recovery System (MACRS). This means you can spread out the depreciation of your HVAC system over a 5-year period.

- Total depreciation period for residential rental property: 27.5 years

- HVAC system specific depreciation: 5 years

- Bonus depreciation: Currently at 80% for 2023

Bonus depreciation rules add complexity. From 2018 to 2022, it was 100%. Now, it’s 80% and will keep going down until it ends on December 31, 2026.

| Year | Bonus Depreciation Percentage |

|---|---|

| 2022 | 100% |

| 2023 | 80% |

| 2024 | 60% |

| 2025 | 40% |

| 2026 | 20% |

To understand how long you depreciate HVAC systems, you need to know IRS rules and current tax laws. Talking to a tax expert can help you figure out how to depreciate HVAC systems. This way, you can get the most tax benefits.

Explore Our HVAC Shop

Looking for top-rated HVAC tools, parts, and accessories? Visit our shop and find the perfect solution for your needs.

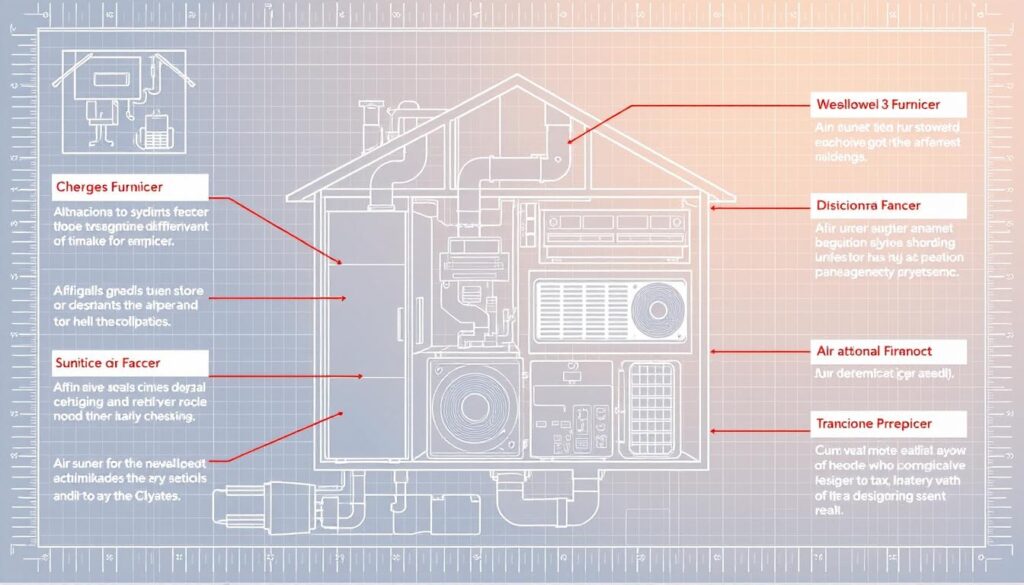

Visit the ShopTypes of HVAC Systems and Their Depreciation Periods

Knowing the depreciation periods for different HVAC systems is key to getting the most tax benefits. Each heating and cooling system has its own tax rules. These rules can greatly affect your rental property’s finances.

Property owners need to follow IRS guidelines for HVAC depreciation. The depreciation time frame changes based on the HVAC system type and how it’s installed.

Central Air Conditioning Systems

Central air conditioning systems are a big investment for rental properties. They depreciate over 27.5 years, giving property owners long-term tax benefits. With an average cost of $3,000, you can deduct about $109.09 each year.

- Installed as a permanent property improvement

- Covers entire residential rental property

- Provides consistent temperature control

Window Units and Portable Systems

Smaller HVAC solutions have a different depreciation schedule. Window units and portable systems depreciate over a 7-year period. This means faster tax write-offs for rental property owners.

- Shorter depreciation timeline

- More flexible installation options

- Lower initial investment cost

Heat Pumps and Combined Systems

Heat pumps and combined HVAC systems have their own depreciation rules. They usually follow the standard 27.5-year schedule for residential property depreciation. This depends on their setup and installation.

Always consult a tax professional to determine the exact depreciation schedule for your specific HVAC system.

Qualifying Criteria for HVAC Depreciation

Understanding the rules for rental property tax deductions on HVAC systems is key for property owners. Not every HVAC installation qualifies for depreciation in residential real estate.

To claim depreciation on your HVAC system, you must meet several key requirements:

- The HVAC system must be used in a rental property for income-generating purposes

- The system must have a determinable useful life exceeding one year

- The property must be held for productive use in a trade or business

- The HVAC system must be properly documented and tracked

Depreciating HVAC systems in residential real estate follows specific IRS guidelines. Your property must be actively rented out, not used as a personal residence. The IRS requires that the HVAC system contributes to generating rental income and has a clear economic lifespan.

“Proper documentation is the key to successful HVAC depreciation claims for rental properties.”

Property owners should maintain detailed records including:

- Purchase invoices

- Installation dates

- Maintenance logs

- Percentage of business use

Remember that residential rental properties depreciate over a 27.5-year recovery period. Your HVAC system’s value will be systematically deducted throughout this timeframe. This provides significant tax advantages for strategic property investors.

Explore Our HVAC Shop

Looking for top-rated HVAC tools, parts, and accessories? Visit our shop and find the perfect solution for your needs.

Visit the ShopCalculating HVAC Depreciation for Tax Purposes

Figuring out how long to depreciate HVAC on rental property is key for tax planning. Getting the right investment property HVAC write-offs can really help your finances.

The IRS has rules for HVAC depreciation using the Modified Accelerated Cost Recovery System (MACRS). For rental homes, you depreciate over 27.5 years. This lets you spread out the cost over time.

Step-by-Step Calculation Method

To figure out your HVAC depreciation, just follow these steps:

- Find the total cost of the HVAC system installation

- Divide the total cost by 27.5 years

- Figure out how much you can deduct each year

- Reduce your property’s value by the yearly deduction

Documentation Requirements

It’s important to keep good records for HVAC write-offs on investment properties. Make sure to save:

- Original purchase invoices

- Installation receipts

- Maintenance records

- Logs of any property improvements

Annual Deduction Formulas

The simplest way is straight-line depreciation. For instance, if your HVAC system is $10,000, you’d deduct about $363.64 each year ($10,000 ÷ 27.5 years).

Pro Tip: Talk to a tax expert to make sure you’re doing it right and getting the most deductions.

Major Components and Their Individual Depreciation Rules

Understanding the depreciation rules for each part of your HVAC system is key when managing rental properties. Different parts have different lifespans and depreciation rates. This can greatly affect your tax strategy.

Property owners need to know that not all HVAC components depreciate at the same rate. Some parts have their own depreciation periods. This can change how you calculate your taxes.

- Compressors typically depreciate faster than the entire system

- Heat exchangers might have different recovery periods

- Electronic control systems follow separate depreciation guidelines

The lifespan of your HVAC system in rental properties can vary. For example, a central air conditioning system might depreciate over 27.5 years. But its parts could have shorter depreciation times.

| HVAC Component | Typical Depreciation Period | Tax Implications |

|---|---|---|

| Compressor | 7-10 years | Faster write-off |

| Heat Exchanger | 15-20 years | Moderate depreciation |

| Electronic Controls | 5-7 years | Quick depreciation |

Tracking each component’s depreciation can help you get more tax deductions. It also helps manage your HVAC maintenance costs.

Keeping detailed records of each HVAC part’s replacement and costs is vital for accurate tax reporting.

Impact of HVAC Improvements on Depreciation Schedule

Understanding rental property tax deductions for HVAC systems is key. Knowing how improvements change your depreciation schedule is important. Property owners need to know the difference between routine repairs and big improvements to get the most tax benefits.

Repairs vs. Capital Improvements

It’s important to know the difference between repairs and improvements for taxes. Here’s a simple guide:

- Repairs: These are maintenance tasks to keep the HVAC system running.

- Capital Improvements: These are big upgrades that make the system last longer or increase the property’s value.

Capital Expenditure Considerations

The Tax Cuts and Jobs Act (TCJA) offers big benefits for property owners. Qualified HVAC improvements can now be:

- Immediately written off under Section 179

- Depreciated over 15 years

- Eligible for 100% bonus depreciation

What makes something a capital improvement? Look at these factors:

- How much of the system is replaced

- The type of improvement

- How it changes the building’s function

For instance, replacing a whole HVAC system is a capital improvement. But fixing a small part might just be a repair. Talking to a tax expert can help you understand these rules better.

Explore Our HVAC Shop

Looking for top-rated HVAC tools, parts, and accessories? Visit our shop and find the perfect solution for your needs.

Visit the ShopCommon Mistakes in HVAC Depreciation Reporting

Dealing with HVAC depreciation in residential real estate can be tough. Many property owners make mistakes that hurt their tax deductions for HVAC. These errors can be costly.

Property owners often face issues that can lead to tax problems. Knowing these common mistakes can help you avoid them. This way, you can keep your investment safe and get the most from your tax benefits.

- Miscalculating Depreciation Periods: Many investors get the depreciation time wrong for HVAC systems. The IRS has clear rules for each type.

- Poor Documentation Practices: Not keeping good records can make your tax deductions for HVAC invalid.

- Misclassifying Expenses: Mixing up repairs with improvements can mess up your tax reports.

Here are some important things to remember:

- Keep track of when you installed your HVAC systems.

- Save all receipts and maintenance records.

- Know the difference between repairs and improvements.

“Accurate depreciation reporting is not just about tax compliance, it’s about protecting your investment’s financial integrity.”

The IRS assumes you’ve taken the depreciation you can, even if you haven’t. This can mean you’re missing out on tax deductions. These missed deductions can affect your rental property’s finances for a long time.

For rental properties, the IRS says you can depreciate them over 27.5 years. But, HVAC systems might have different depreciation times. This depends on if they’re for personal or residential use.

Conclusion

Knowing how long to depreciate HVAC on rental property is key for real estate investors. The IRS says you can depreciate residential rental properties over 27.5 years. This affects how you calculate HVAC depreciation. By using smart depreciation strategies, you can save a lot of money.

Keeping good records and tracking costs is vital for HVAC depreciation. You need to document all purchases, improvements, and installation costs. A certified public accountant can help you understand the rules and get the most tax deductions.

How you depreciate HVAC can greatly affect your investment returns. Different parts of the HVAC system may have different depreciation times. Remember, upgrades must be documented to get the best tax benefits.

Real estate investing is all about knowing how to depreciate. Stay up to date with IRS rules, keep detailed records, and get professional advice. This way, HVAC depreciation can be a big financial win for your rental properties.